CPE delivered to you. To bring you more CPE options, you can now search on the CPE Catalog page for over 1500 high quality webinars from our team of webinar partners listed below. Use the Training Type filter and indicate Online. Choose your webinar and register right on the NMSCPA website. It couldn’t be easier!

| CPA Crossings, LLC: offers over 2300 NASBA-approved webinars per year on almost 300 topics in the areas of technology, practice management, workflow automation, tax, ethics, fraud, and accounting & auditing. They offer one- to eight-hour courses with flexible scheduling, including evenings and Saturdays, so you can easily fit professional education into your schedule. |

|

| Washington Society of CPAs: The New Mexico Society of CPAs is excited to announce our recent partnership with The Washington Society of CPAs. Along with 10 other society's, New Mexico and Washington have come together to share the cost of classes to ensure more classes run throughout the year! This means more options, and little to no cancellations! Please Note the Following: • Registrations and payments will happen through the New Mexico Society of CPAs. • Materials, Links, Surveys, and Certificates will come from the Washington Society of CPAs • Though Your Certificates will come from Washington, your credits will be eligible and count towards your New Mexico credits and license. |

|

| CalCPA Education Foundation: The California Society of CPAs offers hundreds of technical and nontechnical webcasts by leading experts delivered straight to your desktop. They provide an easy, fast and convenient way to stay current. |

|

|

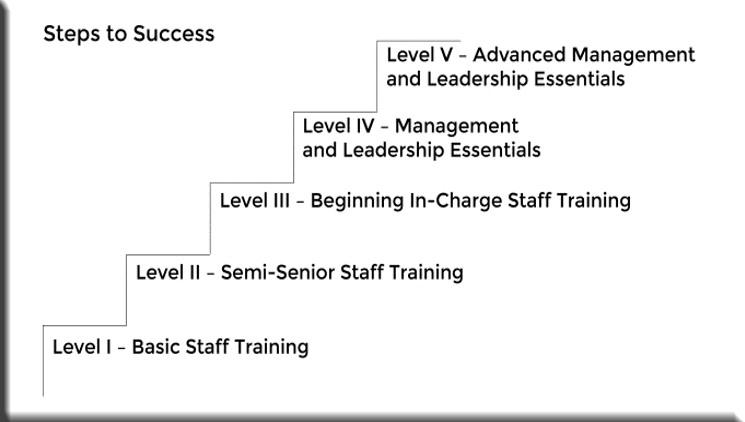

AHI Associates provides Virtual Audit Staff and Leadership Training. Ranging from Level I (Basic Staff Training) to Level V (Advanced Management and Leadership Essentials). The New Mexico Society of CPAs is excited to announce our recent partnership with AHI Associates to bring you these next level training opportunities.

Levels I through 3 (each level meets over four days for a total of 24 credits) Over the course of these levels attendees will focus on the theory behind audits, reviews, compilations, and financial statement preparation engagements. AHI believes that by understanding the “why” behind the procedures, new staff will be prepared for all types of engagements that will arise in their career. Participants apply these concepts to realistic case scenarios, with a focus on understanding the process rather than the format. The goal is to develop thinkers, not just doers. Levels I through III courses are designed especially for any staff who will be performing audits, reviews, compilations, or financial statement preparation engagements. Levels 4 (24 credits; meets over 4 days) and 5 (16 credits; meets over 4 days) Throughout these next-step levels, leadership concepts and soft skills training that benefits both the person attending and their organization will be introduced. These two levels are applicable for various accounting departments (i.e. audit, tax, consulting, and accounting services) as well as applicable to other professional business leaders. These concepts apply to all individuals with significant supervision and management responsibilities. |

Staff Training: Basic - Level I

Staff Training: Beginning-in-Charge - Level 3

|